Schwab inherited ira rmd calculator

TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc. You can withdraw it all at once or in intervals as long as youve withdrawn all assets by Dec.

Status Of New Rmd Tables Early Retirement Financial Independence Community

If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD.

. The SECURE ACT of 2019 raised the age for taking an initial RMD to 72 beginning in 2020 for individuals not already 70½ the previous age was 70½. 31 of the 10th year after your spouse died. 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account Custodial Account Overview Custodial Transfer Personal Choice Retirement.

Call us at 800-435-4000. The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and costly mistakes. Follow these instructions for establishing and contributing to a SEP-IRA plan.

Is a trademark jointly. Rollover Inherited SEP or SIMPLE IRA youll need to take an RMD. Schwab is not responsible for the accuracy or completeness of the information you provide including what you.

If you have a non-Roth IRA at Schwab call a Schwab investment professional at 866-855-5635 to start the conversion process. College Savings Calculator 529 Savings Plan Overview. The deadline to take your first RMD is normally April 1 of the year after you turn 72 and December 31 each following year.

IRA Education and Custodial Overview College Savings Calculator 529 Savings Plan Overview. With a Roth 401kunlike a Roth IRAyou must take a required minimum distribution RMD beginning at age 72 for those born on or after July 1 1949 if youre retired. Scott Royal Smith is an asset protection attorney and long-time real estate investor.

Choose from ETFs for easy diversification professionally managed mutual funds and much more. Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade. TD Ameritrade Inc member FINRASIPC a subsidiary of The Charles Schwab Corporation.

A required minimum distribution RMD is the minimum amount of money that a Traditional IRA holder is required to withdraw annually once they reach the RMD age threshold. Start here with the Inherited IRA calculator or if applicable jump to the Traditional IRA calculator. Review the basic plan document which describes and governs your account and keep it for your records.

Explore The Benefits Of A Rollover With Us. Rollover a prior 401k to an IRA. Hes on a mission to help fellow investors free their time protect their assets and.

Certain requirements must be met to trade options through Schwab. They only apply to accounts that are inherited in 2020 and beyond. But instead of taking RMDs based on your life expectancy youll have 10 years to withdraw the full balance.

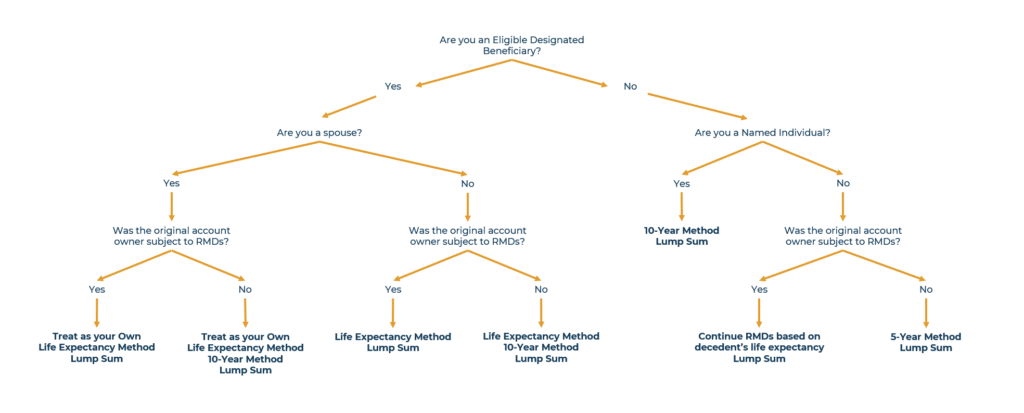

Do not use this form for Inherited RMDs. Rules vary depending on whether you inherit an IRA from a spouse or non-spouse. Use our Beneficiary RMD calculator This tax information.

Submitting an IRA Distribution form. And one more thing. College Savings Calculator 529 Savings Plan Overview.

Schwabs Personal Defined Benefit Plan helps self-employed and small business owners save aggressively for retirement. Calling us to request a distribution verbally at 866-855-5635. Transferring RMD funds in-kind ie.

Consult your tax advisor. Inherited IRA Inherited IRA Account Withdrawal Rules Custodial IRA. If you inherited a Schwab QRP or Individual 401k.

No need to sell to a non-retirement account at Schwab or elsewhere Coming into a Schwab branch directly. Open a Schwab Inherited IRA today or call 866-855-5635 if you need help. Charles Schwab Co Inc.

Inherited Roth IRA 10-Year Method The same inherited Roth IRA rules listed above will apply. Schwab Can Help You Make A Smooth Transition. For those who inherit a Traditional or Roth IRA.

RMDs are not required with Roth IRAs unless you inherit a Roth IRA from a non-spouse. Do not use this form for Inherited RMDs. Ad Use This Calculator to Determine Your Required Minimum Distribution.

Get the investment products you need at Schwab. Call us at 800-435-4000 and well send you a Schwab RMD. Schwab Inherited IRA Distribution Form.

Regardless of the withdrawal schedule the deadline is important. So the idea of rolling your Roth 401k money into a Roth IRA before that magic age makes a. Build your own portfolio or contact a Schwab investment.

Ad Schwab Has Hassle-Free Rollover Help From Start To Finish. With the Life Expectancy method if your father didnt take an RMD in the year of his death you must take an RMD by December 31 of that year. Inherited IRA Inherited IRA Account Withdrawal Rules Custodial IRA.

With a Schwab IRA you have a wide range of investment options to choose from including stocks bonds CDs ETFs and mutual funds. Inherited IRA Inherited IRA Account. Roth IRA Withdrawal Rules.

Note that the new rules under the SECURE Act do not affect existing inherited accounts. Schwab a licensed insurance agency distributes certain insurance and annuity contracts that are issued by insurance companies that are not affiliated with Schwab. RMD withdrawals only if calculated by by Protective Life.

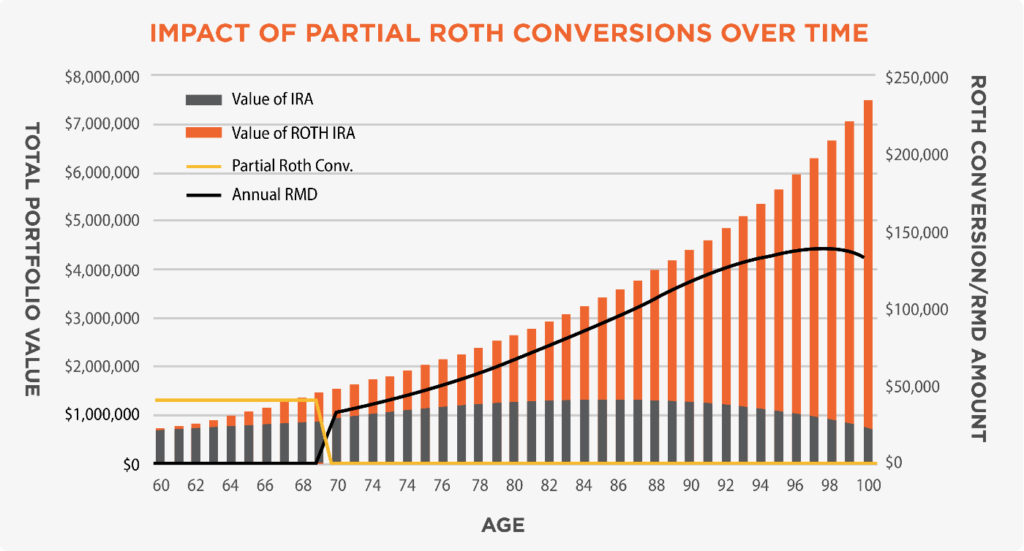

If youre not forced to take an RMD in a given year consider taking money from your Roth IRA or Roth 401k instead and avoid generating taxable income. If you have a non-Roth IRA or a 401k somewhere other than Schwab you have two options. Once you have your RMD whats next.

Use the Request an IRA Distribution Form Complete this form if you wish to take a Required Minimum Distribution RMD from your account. Required Minimum Distribution RMD withdrawals must begin by age 70½ if you were born before July 1 1949 or age 72 if you were born on or after July 1 1949. Print and complete the adoption agreementRetain a copy and return the signed original to Schwab.

Inherited IRA Inherited IRA Account Withdrawal Rules. Investing involves risks. Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors.

The Charles Schwab Corporation provides a full range of. Donate your required minimum distribution. The IRS penalty for not taking an RMD or for taking less than the required amount is steep.

Transfer your non-Roth IRA or your 401k to an IRA at Schwab. Get the facts about Inherited IRA withdrawal rules and distributions. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions.

50 of the amount not taken on time. Qualified Retirement Plan QRP and Keogh Distribution Request Form. And The Toronto-Dominion.

Explore Schwabs investment advice options. If you plan to take a distribution before you reach age 59½ you can open an Inherited IRA. Like a traditional 401kand unlike a Roth IRAyou do have to take a required minimum distribution RMD from a Roth 401k unless youre still working for that employer.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

What To Do If You Inherit An Ira Post Secure Act Wealthspire

Rmd Taxes Required Minimum Distributions Form 5329

Improving With Age Humbledollar Investment Portfolio Personal Finance Revocable Living Trust

1

Where Are Those New Rmd Tables For 2022

Inherited Ira Rmd Calculator Td Ameritrade

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

What S Your Inherited Ira Required Minimum Distribution

Where Are Those New Rmd Tables For 2022

3

Required Minimum Distribution Rules Sensible Money

1

1

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition